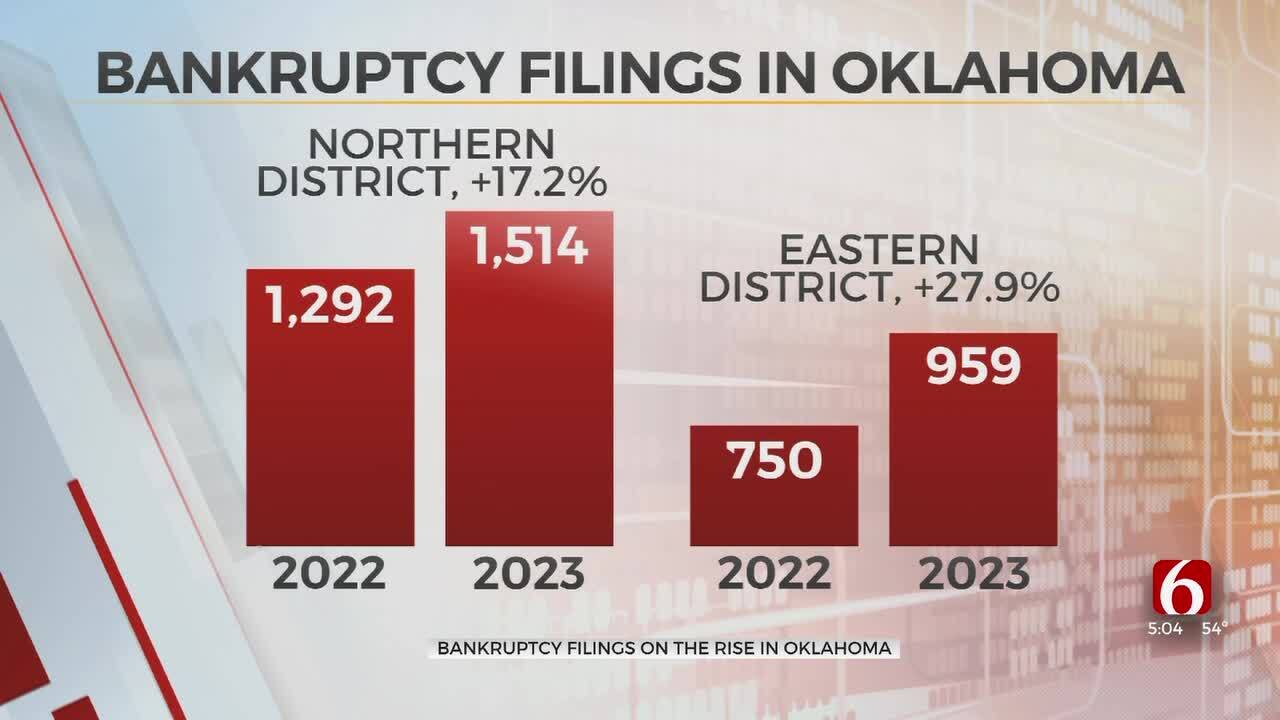

Bankruptcy Filings Up 28 Percent In Eastern Oklahoma

More people and businesses in Oklahoma are filing for bankruptcy, jumping as high as 28% in some parts of the state.Wednesday, March 27th 2024, 5:49 pm

More people and businesses in Oklahoma are filing for bankruptcy, jumping as high as 28% in some parts of the state.

There were about 6,000 bankruptcy filings across Oklahoma in 2023.

Oklahoma has three federal courthouses where people and businesses may file for bankruptcy.

Experts say they expect a continued rise in bankruptcies because of inflation, stagnant wages and easy access to credit.

"They try to rob Peter to pay Paul, and then it just gets in deeper and deeper,” said Mark Bransford with The Bankruptcy Attorneys of Tulsa.

Bransford said he has had more clients looking for help over the last four years.

"They come from all walks of life,” said Bransford. “I get low income, medium income. I get lawyers, doctors.”

Records show bankruptcy filings jumped about 17% in the Northern District of Oklahoma and 28% in the Eastern District.

Filing records in the Northern District show Tulsa County had more than 900 filings last year, including 46 from businesses and 858 from individuals.

Tina Herndon, a financial educator with Tinker Federal Credit Union, said she believes there are several factors for the increase.

"Everything from inflation, stagnant wages, to just the way we manage our money, the instant credit's widely available, all of those things are contributing to decisions that could lead to bankruptcy,” said Herndon.

Herndon said the best thing to do after filing for bankruptcy is to rebuild your credit.

"It's getting someone to take a chance on you, so just getting someone to give you a line of credit, whether it be a credit card or a loan, maybe even secured by savings, that can really help someone rebuild," said Herndon.

Bransford said the law has options for people and businesses to work on their debts, despite misconceptions.

"It's terrible,” said Bransford. “They come in here. A lot of them are crying. They're so stressed out about trying to fix their problem."

Herndon said everyone should learn to budget and work with a financial counselor.

Tinker Federal Credit Union offers financial education for groups at no cost. You can find more information HERE.

More Like This

March 27th, 2024

June 16th, 2025

June 16th, 2025

June 16th, 2025