Why Facebook Shares Are Sinking Like A Stone

<p>Facebook shares opened sharply lower after posting disappointing results on Wednesday. </p>Thursday, July 26th 2018, 11:42 am

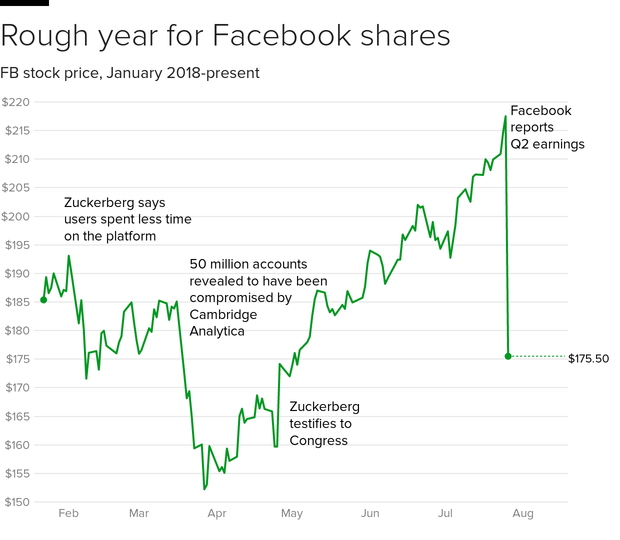

Facebook shares opened sharply lower after posting disappointing results on Wednesday. The social media giant's stock slid more than 18 percent in early trade after losing as much as $150 billion in market value on Thursday following a second-quarter earnings report that showed slowing growth.

Investors were spooked by Facebook's forecast showing that its number of active users is growing less quickly than expected, while the company also took a hit from Europe's new privacy laws.

The report, which marked Facebook's first full quarter since the Cambridge Analytica scandal, startled investors with a bevy of red flags about setbacks to its revenue and user growth. Indeed, the drop Thursday morning was sharper than the multi-day stock slide in March following revelations of data misappropriation by Cambridge and others. (Facebook shares dropped 17.8 percent then, bottoming out at $151.65 on March 28.)

Yet Facebook is hardly a stranger to a volatile stock price and has rebounded from previous mishaps, including Cambridge Analytica. While several analysts downgraded the stock, others say they still have faith in the company to grow over the long-term.

"Even the best hitters strike out sometimes," wrote Wedbush analyst Michael Pachter, who lowered his 12-month price target to $250 from $275, in a research report. "In our view, the sell-off is overdone and largely unwarranted."

Still, investors weren't prepared for many of the bombshells dropped by Facebook Chief Financial Officer David Wehner.

A hit from Europe

European advertising revenue growth in Europe "decelerated more quickly than other regions," partially because of the new European privacy laws, Wehner said. That surprised investors because of the belief that the new laws wouldn't hurt revenue.

The new laws were only in effect for one month of the quarter, which means the company may feel more of an impact in the current quarter. The new regulations are also affecting user growth in the region because of the impact of requiring consumers to opt-in to Facebook and to linking their accounts to third-party websites, Pachter said.

"The implementation of GDPR gave a large number of Facebook users control over their privacy, and it should have been patently obvious to investors (and to us) that allowing users control would result in slightly lower engagement," he noted, alluding to Europe's General Data Protection Regulation privacy rule.

Instagram worthy?

Some investors were also dismayed with Facebook's revelation about Instagram Stories, which allow users to post videos or photos that disappear after a day. Like Facebook, Instagram depends on ads to generate revenue, and Stories is supposed to help sell more ads.

But Wehner said the product has "lower levels of monetization," while adding that the company plans to invest in growing the service. "That's going to have a negative impact on revenue growth," he noted.

Profitability woes

Facebook has drawn investors because of its fast growth of users and profits. Yet both categories are facing headwinds. In case of the latter, Wehner noted that "total expense growth will exceed revenue growth in 2019," pushing down operating margins.

Investors closely watch operating margins because they serve as an important metric for profitability. The lower the operating margin, the less profitable the business. Facebook warned that its operating margins would fall from its current 44 percent to the "mid-30s."

User growth was "lackluster," Pachter noted.

So is it time to unfriend Facebook? Some analysts argue that its long-term outlook is favorable, with RBC Capital Markets' Mark Mahaney writing that the sell-off may represent "one of the best entry points you can get on FB," according to Bloomberg.

And in the view of BTIG analyst Rich Greenfield, Facebook is making an investment that will pay off down the road.

"Facebook is actively choosing to make less money, deprioritizing near-term monetization to drive engagement to even higher levels to capture even more of their 2.5 billion monthly users' time and attention," he wrote. "Legacy media executives... should not be rejoicing -- they should be afraid, very afraid."

© 2018 CBS Interactive Inc.. All Rights Reserved.

More Like This

July 26th, 2018

April 30th, 2025

April 30th, 2025

April 30th, 2025

Top Headlines

June 7th, 2025

June 6th, 2025