Many Families To Receive Increased Child Tax Credit; IRS Explains How Qualify Or Opt-Out

Monday is Child Tax Credit Awareness Day designed to make parents aware of a big change with this tax credit.Monday, June 21st 2021, 6:27 am

TULSA, Oklahoma -

Monday is Child Tax Credit Awareness Day designed to make parents aware of a big change with this tax credit.

President Joe Biden signed the enhanced Child Tax Credit into law earlier this year as part of the American Rescue Plan. That plan increased the Child Tax Credit from $2,000 per child to $3,000 for kids 6 and up. For kids under the age of six, it increased to $3,600.

Families will get the full credit if they make up to $150,000 for married couples and $75,000 dollars for single parents. The money will be paid out in cash on a monthly basis starting July 15 through December. The rest is claimed on your 2021 tax return. Some families may get money but don't qualify for the credit and they need to opt out or families could be getting too much money.

If that's the case you'll have to pay the IRS some or all of that money back.

You do have to opt out of the monthly payments if you'd like your increased Child Tax Credit in one lump sum with next year's refund. The IRS said you can do that using an online tool. However, it's not yet available but the IRS says it should be on its website by the end of this month.

For more information CLICK HERE

More Like This

June 21st, 2021

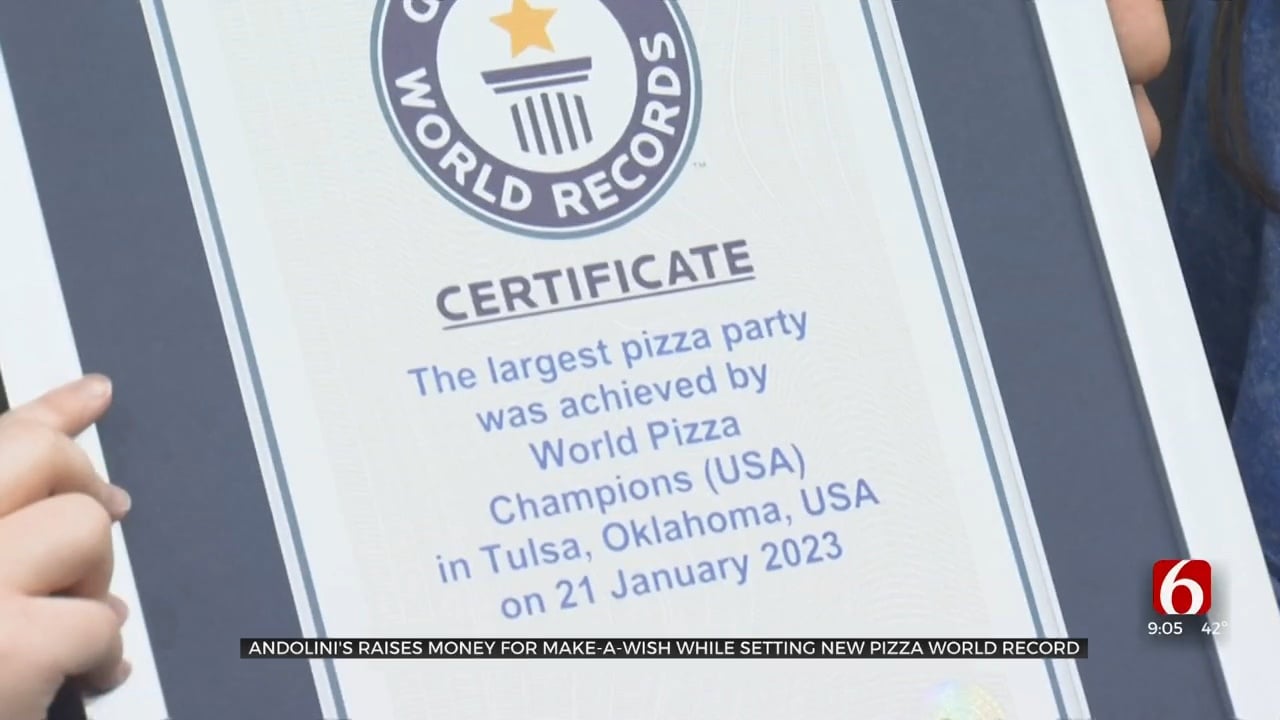

January 21st, 2023

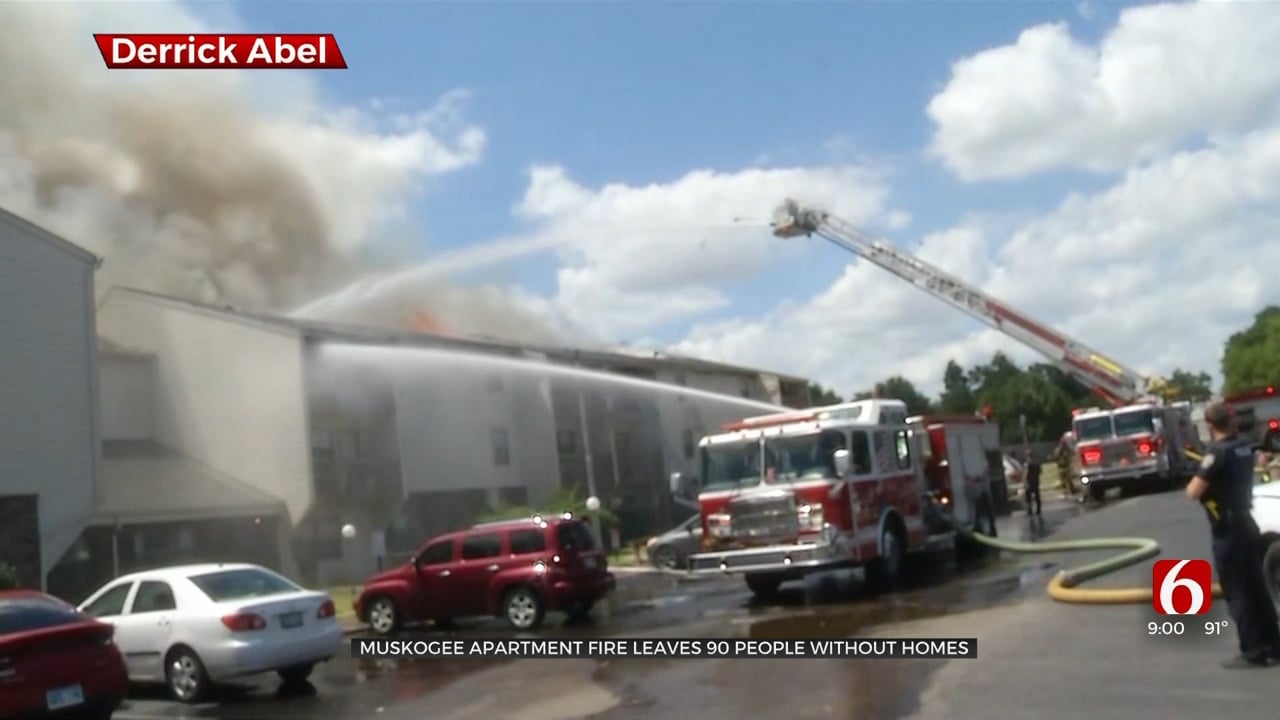

October 28th, 2021

Top Headlines

April 25th, 2024

April 25th, 2024

April 25th, 2024

April 25th, 2024