Oklahoma Bank Misses Fifth Consecutive TARP Payment

An Oklahoma bank that took millions of dollars in federal bailout money claims to be in good health, and yet is failing to pay taxpayers back as scheduled.Wednesday, November 16th 2011, 10:22 pm

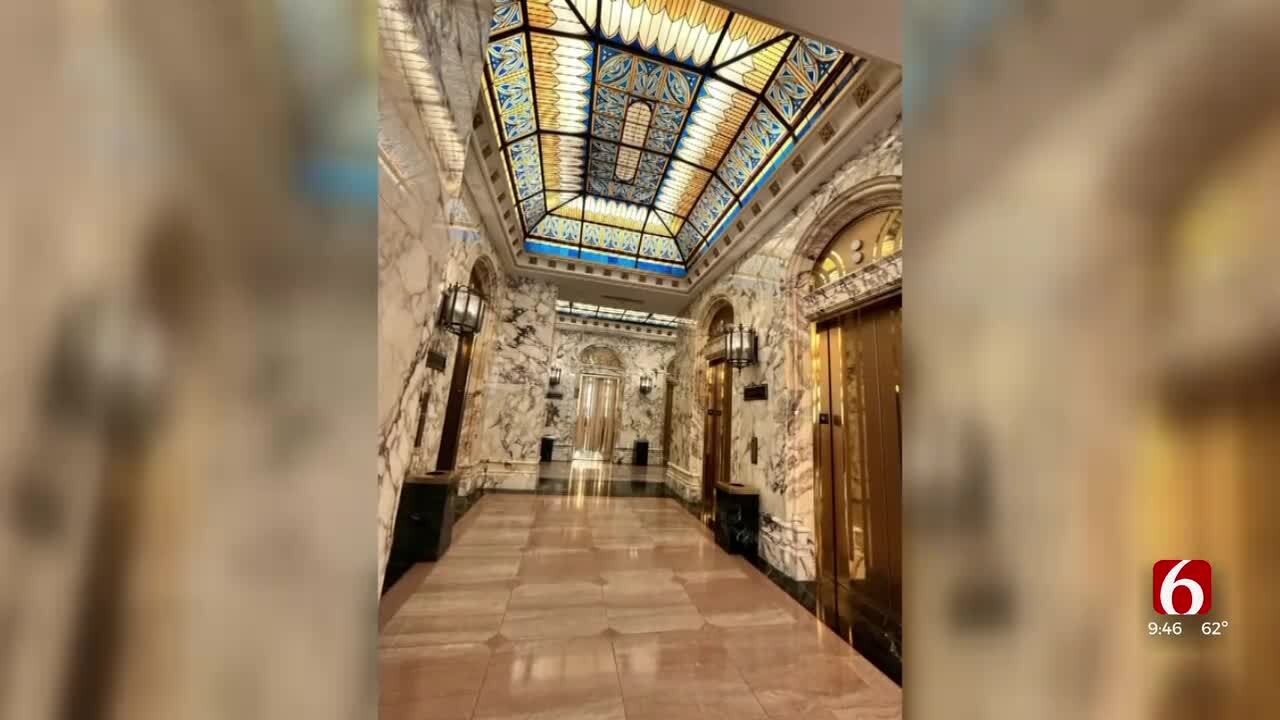

An Oklahoma bank that accepted millions of dollars in bailout money from Washington is failing to pay taxpayers back as scheduled. Tulsa-based Spirit Bank had a $407,000 quarterly dividend payment to the U.S. Treasury due today, but deferred making it -- the fifth straight quarter the bank has failed to make its payment.

As part of TARP -- the Troubled Asset Relief Program -- Spirit Bank got $30 million in March 2009. Spirit Bank was one in five banks in Oklahoma to receive badly needed capital through TARP's Capital Purchase Program. In all, the government doled out $205 billion to 707 banks across the country. The goal was to provide stability to the financial sector by helping viable lending institutions continue lending. But now, three years after the first loans were made, many of those banks -- community banks, especially -- are having trouble paying the money back.

03/27/2009 Related Story: Spirit Bank Accepts Federal Loan

More than half of the banks have yet to make full repayment, and about half of those have missed at least one quarterly payment. Spirit Bank is not alone in missing multiple payments -- approximately 100 banks have deferred payment five or more times.

Paul Cornell, the President of Spirit Bank's holding company, told the Oklahoma Impact Team that the decision to defer payment was made at the recommendation of the bank's federal regulator. Cornell explained that it's not a matter of a lack of capital. He says the bank's capital is higher than it's ever been, and that the bank is strong.

Cornell said he can't predict when Spirit Bank will make its next payment. He says it depends on the regulatory environment. The next scheduled payment is in February.

Under the terms of the Capital Purchase Program loans, participating banks are allowed to defer payments. Once a bank misses five payments, however, the Treasury may request permission to send a representative to the bank's board meetings. If the number of deferred payments reaches six, Treasury is entitled to nominate up to two people to sit on the bank's board.

More Like This

November 16th, 2011

March 22nd, 2024

March 14th, 2024

February 9th, 2024

Top Headlines

April 24th, 2024

April 24th, 2024

April 24th, 2024

April 24th, 2024