Student Loan Debt Continues To Grow With New School Year

At college campuses here and across the state, fall classes are getting underway, which means thousands more Oklahomans are entering the ever-growing world of student loan debt.Monday, August 17th 2015, 7:16 pm

At college campuses here and across the state, fall classes are getting underway, which means thousands more Oklahomans are entering the ever-growing world of student loan debt.

For Oklahomans, the news isn't all bad, but even the silver lining has a sharp edge.

Total student loan debt in the U.S. is now estimated at $1.3 trillion, according to the Federal Reserve. That's significantly higher than both auto loan debt and credit card debt, and is second only to total mortgage loan debt.

The latest data shows more of the students who accumulated that debt are having difficulty paying it off. Federal Reserve numbers show that, for the quarter that ended in June, payments on 11.5 percent of all student loan debt were at least 90 days delinquent. compared to 11.1 percent the previous quarter.

The national delinquency rate for credit card debt is 8.4 percent.

Experts attribute the disparity, in part, to the fact that underwriting standards for student loans are less strict than for a bank issuing a credit card. The federal government, which underwrites the vast majority of student loans, doesn't check a student's credit history as a bank would before issuing a credit card.

The good news for Oklahoma is that, relatively speaking, its student loan debt levels are low.

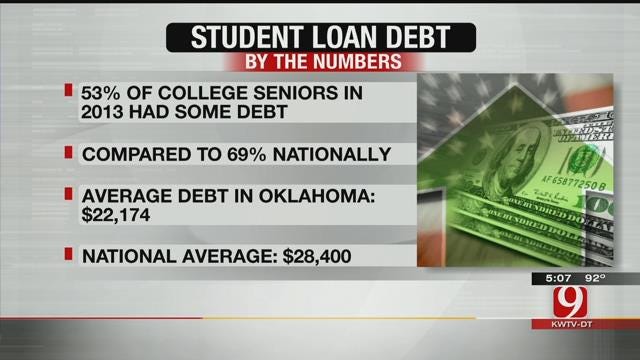

According to a study released last November by the Institute for College Access & Success, 53 percent of Oklahoma's class of 2013 had some amount of student loan debt. The national average is 69 percent.

Of those with debt in Oklahoma, the average amount owed is $22,174 -- 46th lowest in the country. The national average is $28,400.

New Hampshire leads the nation in average student debt at almost $33,000. The lowest in the land is New Mexico at $18,600.

On this current track, the Congressional Budget Office estimates student borrowing will double by 2025, which helps to explain why some of the presidential candidates are now talking about this out on the campaign trail.

More Like This

August 17th, 2015

March 22nd, 2024

March 14th, 2024

February 9th, 2024

Top Headlines

April 25th, 2024

April 25th, 2024