Some Taxpayers Will Have To Wait To File 2010 Tax Returns

A warning for people anxious to file their taxes in the new year. <br><br><a href="http://www.newson6.com/Global/story.asp?S=13746508" target="_blank">Americans Will See Bigger Paychecks In 2011</a>Tuesday, December 28th 2010, 4:43 pm

Tara Vreeland, News On 6

WASHINGTON -- A warning for people anxious to file their taxes in the new year.

The new tax package signed last week not only means tax cuts for us, It means headaches for tax preparers and the IRS.

The IRS says it needs time to reprogram its computers. So tax preparers are warning taxpayers to not get too anxious to file their returns.

Taxpayers rejoiced at the news of a paycheck boost after President Obama signed the new tax package bill.

12/27/2010 Related Story: Americans Will See Bigger paychecks In 2011

"For the next two years, every American family will keep their tax cuts, not just the Bush tax cuts, but those that have been put in place over the last couple of years," the president said.

But that bill has left the IRS to scramble.

"IRS is going to get pounded for being the bad guy on this when they are not," said Ceil Bowers, owner of Bowers Tax Services.

The IRS will now have to overhaul their computers to accommodate the last-minute changes for the 2010 tax season which means eager tax filers need to hold off.

"My real fear is if they go ahead and try to file and they put it into the computer and the computer will disregard those deductions," Bowers said.

Those impacted fall into three categories:

1. Taxpayers that itemize.

2. Teachers with educator expense deductions.

3. People paying higher education tuition and fees deductions.

"I just think it's important that they know that those deductions mean money to them," Bowers said.

Meaning the best advice is to wait to file while the government sorts it out.

"If they say mid to late February, they are being optimistic I think," she said.

IRS Commissioner Doug Shulman says the majority of taxpayers will be able to fill out their tax returns and file them as they normally do.

However, those who fall under those three categories must wait until mid to late February to file.

Taxpayers are urged to use e-file instead of paper tax forms to avoid confusion over the recent changes and to make sure tax returns are accurate.

More Like This

December 28th, 2010

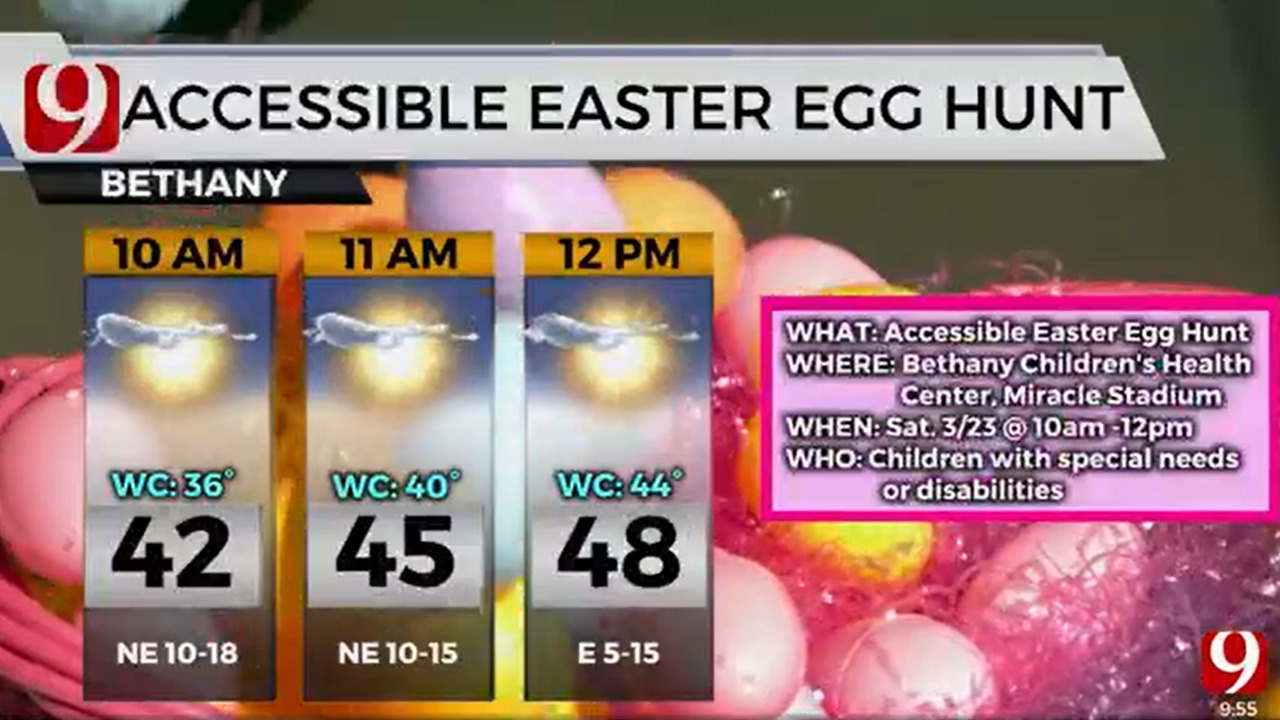

March 22nd, 2024

March 14th, 2024

February 9th, 2024

Top Headlines

April 19th, 2024

April 19th, 2024

April 19th, 2024