City Says Online Short-Term Rentals Are Costing OKC Tax Revenue

<p>It's a growing trend that's sending more people into neighborhoods for their vacation stays instead of traditional hotels.</p>Tuesday, February 21st 2017, 5:30 pm

It's a growing trend that's sending more people into neighborhoods for their vacation stays instead of traditional hotels.

More and more visitors are turning to websites like Airbnb and VRBO to make reservations for their trips.

“It was really an experiment,” said Andy Zeeck.

Zeeck said he recently opened a one bedroom home near Western Avenue and NW 45 to guests through the website Airbnb.

Zeeck charges $100 night and a $50 cleaning fee for the 500 square foot space that comes with cable, a washer and dryer, and a spacious backyard.

At Airbnb and VRBO, you can see the hundreds of properties he's competing with each weekend in Oklahoma City.

“I see it as an expanding market,” said Zeeck.

A market, the City said, its being shut out of.

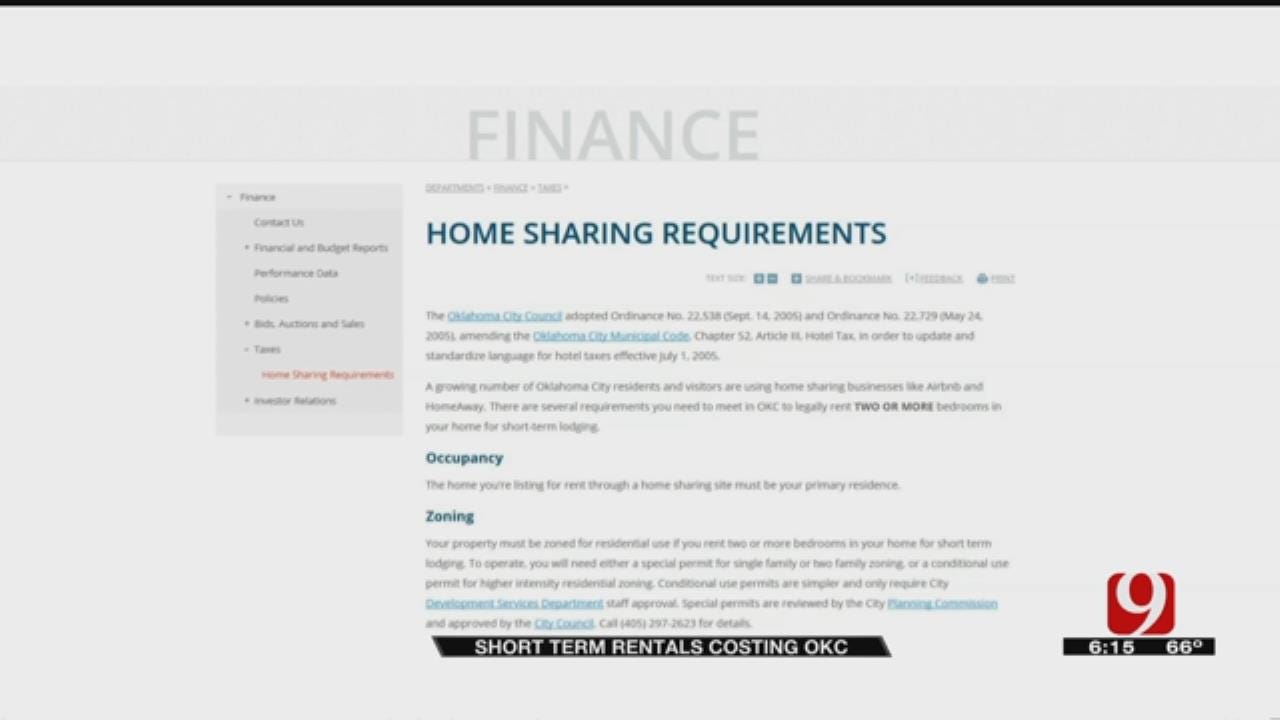

It’s trying to treat short-term rentals as hotels and have owners collect a hotel and sales tax from guests and get a special permit.

The City admits property owners haven’t been collecting the tax for the most part.

It also said information on its website about home sharing zoning requirements is incorrect.

“Our codes aren’t written for this type of business,” said Oklahoma City spokeswoman Kristy Yager.

Yager said the City is working on solutions including having sites like Airbnb collect taxes that are passed along to the City.

Yager said the City has been hearing from hotels, upset over the tax advantage home share websites seem to have on the market.

Hotel occupancy was down in 2016 compared to the previous year in Oklahoma City.

More Like This

February 21st, 2017

March 22nd, 2024

March 14th, 2024

February 9th, 2024

Top Headlines

April 17th, 2024